Chicagoland is sizzling in peak rental season, but Miami is even hotter

Share this article:

Securing a rental is always tough during the peak moving season. And although thousands of new apartments are popping up across the country, renters are nevertheless navigating yet another challenging summer.

To that end, Miami remains the country’s most competitive rental market in peak rental season, but the Chicago metropolitan area has become even hotter for apartment-hunters, who are faced with significantly fewer options to choose from. Meanwhile, two other Midwestern locations — the Suburban Twin Cities and Milwaukee — have also become extremely competitive during peak rental season.

Key takeaways:

- The national RCI score sits at 74.6 this peak moving season, with more renters renewing leases even as occupancy softens slightly.

- Chicagoland has emerged as a red-hot rental market, while Miami holds its spot as the nation’s most in-demand hub.

- The Twin Cities and surrounding suburbs are the fastest-rising markets with San Francisco also getting hotter thanks to the AI boom.

- Brooklyn, NY, leads the Northeast with an RCI of 85.1, while all NYC boroughs show rising competition and faster apartment turnover despite fewer renewals.

- Lafayette, IN, is the nation’s tightest small rental market as the Midwest maintains steady demand, although the Northeast ranks first at a regional level.

Interestingly, the Midwest — which has long been a go-to for apartment-hunters — is now getting some serious competition from the Northeast. This is mostly because New York City is back on the radar for many young professionals, who are now finding lots of brand-new apartments due to a recent construction boom in Brooklyn and Manhattan, NY.

With the rental market reaching a record high this summer, we wanted to see what other options Americans had when searching for a new place to call home. To get a clear picture, we looked at five key indicators of rental competitiveness:

- the number of days apartments were vacant

- the percentage of apartments that were occupied by renters

- the number of prospective renters competing for an apartment

- the percentage of renters who renewed their leases

- the share of new apartments completed recently

To measure the competitiveness of the U.S. rental market during the peak moving season, we calculated a Rental Competitiveness Index (RCI). The national RCI score is 74.6, which indicates a very tight rental market this peak season.

More renters stay put in peak season, yet the overall occupancy rate dips slightly

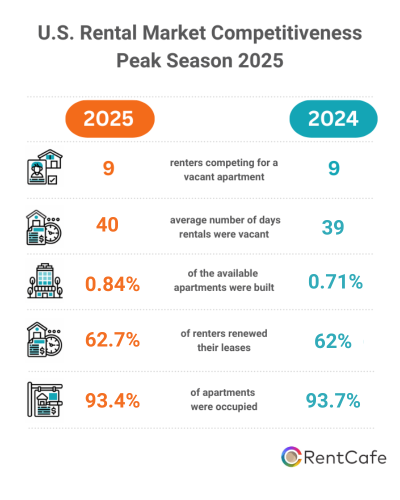

With more than 640,000 apartments built in 2024 and another 506,000 new units on track to open by year-end, the U.S. rental market is working to absorb the flood of new units: Roughly 32% of the 137 markets we analyzed are showing signs of softening this summer compared to one year ago. That’s largely because apartments opened recently make up 0.84% of the existing stock compared to 0.71% last summer.

As a result, the national occupancy rate has edged down from 93.7% to 93.4%. Vacant units are also staying on the market slightly longer — 40 days, on average, versus 39 days last summer — while competition among renters has held steady, with about nine apartment-hunters vying for each available unit.

Moreover, slightly more renters stayed put this season as 62.7% renewed their leases compared to 62% last summer.

What else is contributing to rental competition across the U.S.?

Our analysis also looks at renters’ average length of stay, new lease terms and renewal periods. The data reveals a strong correlation between initial lease lengths and renewals: Renters who commit to longer leases are more likely to renew for extended periods. Similarly, markets where renters stay longer in the same unit tend to experience higher renewal rates.

- Across the U.S., the average renter stays in their apartment for about 28 months. New leases average 12 months, and renewals typically extend for another 12 months.

- Renters in the Northeast have the longest average tenures at 36 months, led by Brooklyn, NY, where the average stay reaches 49 months.

- Apartment-hunters in the Northeast also sign the lengthiest new leases, averaging 13 months. Renters in Long Island, NY, and Northern New Jersey lead with 14-month averages.

- Renewal periods are also longest in the Northeast, averaging 13 months. In this case, renters in both Brooklyn and Queens, NY, extend their stays the longest — an average of 15 months.

Not surprisingly, the Northeast’s rental market is in very high demand this summer. With a low supply of apartments and high homeownership costs, more people are staying in the rental market for longer, leading to fierce competition and high renewal rates.

Consequently, the Northeast is the most in-demand region for apartment-hunters in peak rental season with an overall RCI score of 80.5 (up slightly from 80.4 last summer).

Very close behind, with an RCI score of 80.4, is the Midwest. Its powerful mix of relative affordability compared to coastal locations — in addition to its low supply and easy access to outdoor amenities — has turned it into one of the most sought-after regions for apartment-hunters.

Following closely is Florida with an RCI score of 79.3. The South comes next with an overall RCI score of 76.5, followed by the Mid-Atlantic region (RCI score 75.3); the Southeast (RCI score 72.6); California (RCI score 72.5); the Southwest (RCI score 70.9); and the Pacific Northwest (RCI score 70.5). Notably, the West recorded the lowest RCI score in peak rental season at 69.8.

A decline in new apartments has made renting in Chicagoland tougher than ever

Building on last summer’s surge in competitiveness, Chicago has become a red-hot rental market in peak season, once again highlighting apartment-hunters’ preference for the Midwest’s affordability and easygoing vibe.

That said, Chicago now ranks as the second-tightest rental market in the nation with an RCI score of 89 — up 3.6 points from last year, though still well behind Miami’s lead.

A strong local economy, abundant job opportunities and a steady influx of new residents — despite the high cost of living — continue to fuel demand for apartments in Chicago, particularly in areas near transit hubs, universities and the downtown core. On top of that, Chicago’s cultural appeal, highly rated schools and reliable public transit make it especially attractive to young professionals and families alike.

Even so, apartment construction isn’t keeping pace: Newly built units make up just 0.33% of Chicago’s housing supply, which is down from 0.52% last summer. Consequently, this shortfall is leading more renters to extend their current leases, bringing the renewal rate to 60.2% as compared to 58.7% one year ago. That leaves only 4.6% of units available for those looking for a place to call home.

Of course, with so few options, competition is fierce: Vacant apartments in the Windy City are leased the fastest among large markets — typically within 29 days, which is two days faster than last year — while the number of applicants per unit has climbed to 16, up from 14 last summer.

Next, Suburban Chicago is the third-hottest rental market in the U.S. this peak season. Its RCI score of 88.4 is down 2.9 points from last summer — when it tied Miami for first place — but finding an apartment here remains a major challenge for many renters.

The slight dip in rental competitiveness comes from a few shifts: For instance, vacant apartments now take 34 days to fill (one day longer than last summer) and the number of renters competing for each available unit has eased to 15 (down from 16). This is partly due to a modest increase in fresh supply as newly built apartments now make up 0.18% of the local housing stock, in contrast to 0.11% last summer.

Still, finding an apartment in Suburban Chicago remains very challenging, especially in places like Joliet, IL; Naperville, IL; and Aurora, IL. That’s because lease renewals have inched up from 69.5% to 69.7%, keeping the overall occupancy at a high 95.6% (the same as last year).

Apartment hunting in Miami grows tougher as competition heats up along Florida’s Gold Coast

Once again, Miami is the nation’s tightest rental market this peak season, earning the only RCI score above 92 (92.2), nearly a full point higher than last summer. This comes as no surprise, as competitiveness continues to intensify across both large and smaller rental markets along Florida’s Gold Coast, fueled by an influx of affluent newcomers, who are primarily relocating from New York and California.

Despite an increase in new supply — with recently built units now making up 1.18% of all apartments for rent in Miami versus 1.02% last summer — more renters are staying put. More precisely, lease renewals rose to 71.8% (up from 71.5% one year ago), driving the occupancy rate to 96.5%.

Thus, vacant units average just 32 days on the market (the same as last summer), while competition per unit has increased slightly with 19 eager renters vying for the same apartment compared to 18 one year ago.

Not far behind, Broward County, FL, ranks as the 10th most in-demand rental market in the U.S. this peak season (and the second in Florida) with its RCI score rising 1.3 points year-over-year to 81.6.

The surge is largely driven by stronger lease renewals: Even with newly built apartments making up 1.25% of the housing stock (rising from 0.92% last summer), 68.9% of renters renewed, up from 65.7% a year ago — marking one of the highest increases nationwide.

With that, the occupancy rate edged up to 95.3% from 95.1%. As such, the competition for apartments in Broward County remains fierce with 14 renters per unit (up from 13 last summer), while vacant apartments are typically filled in 38 days.

Further north, Orlando, FL, ranks as the 12th-most competitive rental market this peak season with its RCI score rising 2.1 points to 80.6. Its jump is tied to a sharp drop in new supply as recently built apartments now make up just 0.89% of housing stock, down from 1.63% last summer.

With fewer options, 66.8% of renters in Orlando renewed their leases, up from 65.6% one year ago. Still, occupancy dipped slightly to 94.2%, as compared to 94.8% last summer. At the same time, competition remains steady at 11 renters per unit, while vacant apartments now take about 36 days to lease, which is two days longer than last year.

Rentals lease much faster in New York City’s key boroughs

With more professionals now back in offices across New York City than there were before the pandemic, apartment hunting here can feel like a full-time job.

In particular, Manhattan, NY, ranks as the fourth-hottest rental market in peak rental season and #1 in the Northeast (RCI score 85.1, up 2.9 points year-over-year). As a matter of fact, demand is so high that there are now 12 renters competing for each available unit — three more potential renters per unit than last summer. What’s more, vacant apartments in Manhattan are filled in just 33 days, or four days faster than at this time last year.

Plus, new supply remains very scarce, which pushed Brooklyn’s occupancy rate to 96.2% (up from 95.4% last summer). Interestingly, slightly fewer renters chose to stay put, as the lease renewal rate dipped to 65.1%, which is a decline from 65.8% one year ago.

Not to be outdone, Brooklyn, NY, ranks as the seventh most in-demand rental market in the U.S. with an RCI score of 82.4. In this case, its competitiveness is fueled by historically high rents; an ongoing lack of affordable housing; strong demand from both locals and newcomers; and many would-be buyers remaining in the rental market longer.

Moreover, demand for centrally located, amenity-rich apartments has pushed vacant units to lease faster than last year — averaging just 36 days on the market, which is four days quicker than last summer.

However, the number of applicants per vacant unit dipped to 13, down from 14 last year, and fewer apartment-dwellers chose to renew during the peak moving season (66.6%, down from 69.5%). With that, Manhattan’s occupancy rate eased to 95.9% versus 96.3% one year ago.

Nearby, Queens, NY, ranks #32 nationwide with an RCI score of 74.7. Here again, vacant units are filling faster than last summer — now averaging 44 days on the market, or a full week quicker — while the number of applicants per unit has increased to 12 applicants per unit from nine at this time last year.

At the same time, the borough’s lease renewal rate dropped sharply to 61.4%, after falling from 68.2% last year, suggesting that more renters are looking for better deals on apartments in Queens, even with zero new units opened recently. The borough’s occupancy rate is 94.9%, up from 93.1% last summer.

The Twin Cities & San Francisco are the fastest-rising rental markets

Renting has become much more challenging in several markets compared to a year ago, and the Suburban Twin Cities has emerged as this summer’s top trending rental market. Its RCI score jumped 5.8 points — from 78.5 last summer to 84.3 now.

Here, lease renewals have climbed to 68% from 66.3% last summer, while fewer new apartments are being built. That has pushed occupancy to 94.8%, slightly higher than last year’s 94.3%. Apartments here are now renting three days faster, averaging just 34 days on the market. Competition has also heated up with 12 renters chasing each available unit, as compared to 10 last summer.

Notably, more young families, professionals and retirees are choosing the suburbs for a relaxed lifestyle, spacious housing and plenty of amenities. At the same time, the widening cost gap between renting and buying makes places like Bloomington, MN; Brooklyn Park, MN; Woodbury, MN; Hudson, WI; or River Falls, WI, appealing for renters who are not ready to buy yet.

Not far behind, the Twin Cities of Minneapolis–St. Paul, MN, have also grown tighter, with the metro’s RCI score climbing 4.8 points to 80 in one year. With limited supply, more renters are staying put, thereby causing the lease renewal rate to jump from 61.1% to 64.1%. New apartments make up just 0.54% of the stock, down from 0.86% a year ago.

Here, the overall occupancy rate rose to 93.4%, up from 92.6%. Apartments are renting faster, too, typically within 36 days — two days quicker than last year. And slightly more renters are chasing each unit (11 compared to 10 one year ago).

San Francisco is the second-fastest growing rental market this summer with its RCI score gaining 5.4 points year-over-year to take it from 67 to 72.4. This surge is largely driven by the AI boom and more workers returning to the office, coupled with an ongoing housing shortage.

With so few apartments opening recently, nearly 50% of renters renewed — up from 47.5% last summer — which pushed the occupancy rate to a very high 95.3% from 93.3% a year ago. It’s worth noting here that demand for apartments in San Francisco is so strong that the number of renters competing for each unit has nearly doubled, jumping from seven to 13. Now, vacant apartments fill in about 41 days on average, or two days faster than last summer.

With just 3% of apartments available, Lafayette, IN, is the nation’s hottest small rental market

Shifting to smaller markets, the Midwest remains a hotspot for apartment-hunters, claiming seven spots in the national top 20 for this category. The South follows with five markets, while the Northeast counts four.

Lafayette, IN, emerged as the tightest small rental market this summer by boasting an RCI score of 93.8. Its recent infrastructure upgrades, new apartment communities, revitalized downtown and affordable cost of living are a strong pull among renters, especially young professionals and students.

But, supply isn’t keeping up: No new apartments were added recently, and occupancy has surged to 96.9% — the highest in the country. Even with fewer renters renewing leases this summer (71.9%, down from 75.6% last year), competition is extremely intense. Apartments in Lafayette now fill a week faster (typically within 29 days) than they did a year ago, and each vacant unit attracts 15 applicants, which is an increase from 11 last summer.

The nation’s second-hottest small rental market is Fayetteville, AR (RCI score 89.7). Here, high demand from University of Arkansas faculty and students, along with those from nearby schools, keeps the market very tight. At the same time, new student housing and multifamily projects are drawing in a wider mix of renters, including remote workers, thus expanding the appeal beyond just the student population.

Despite the share of new apartments making up just 0.97% of supply and a slight dip in lease renewals (from 72.8% to 72.1% in one year), occupancy has inched up to 96.6% from 96.5%. Accordingly, apartments in Fayetteville now rent faster than anywhere else in the country, usually after 22 days. Competition is also fierce with 14 renters vying for each vacant unit, rising from 13 last summer.

Lehigh Valley, PA, ranks as the third-most in-demand small rental market in the U.S. Its RCI score of 92.4 highlights demand that outpaces supply, even after a modest 0.19% increase in its housing stock recently. The area’s universities and convenient location near major hubs like Philadelphia and New York City make it especially appealing to young renters.

While the lease renewal rate has dipped from 79.6% to 77.7% in the last year, it still ranks as the third-highest in the nation, behind only Central Jersey (79.9%) and Rochester, NY (78.1%). That leaves fewer than 4% of units available. Here again, competition is intense with 16 renters now vying for each vacant apartment — up from 14 last year — and units typically leasing within 38 days.

Lafayette-Lake Charles, LA, is the top trending small rental market

Ranked by RentCafe.com as one of the best cities for renters in 2025, Lafayette–Lake Charles, LA, is the fastest-rising small rental market. Its RCI score jumped 12.8 points to 83.8 to rank 12th among the most competitive small metros this peak season.

The area combines the 11th-highest job growth rate in the nation (up 2% year-over-year); a cost of living well below average; and a diverse economy in healthcare, energy, shipping and manufacturing. Lake Charles, in particular, is attracting many skilled workers. Affordable, spacious apartments and a thriving cultural scene further boost demand.

Port St. Lucie, FL, ranks second among the fastest-rising small rental markets, after its RCI score gained 10.5 points in one year to reach 86.6. The city’s growing competitiveness stems from a steep decline in new apartments — down from 4.99% to just 0.59% of supply. With that, far more renters are choosing to stay put, which also caused the lease renewal rate to climb to 73.6% this peak season, up from 68.1% last summer.

Browse the maps below to see the rental competitiveness in other regions in the 2025 peak season for moving:

FAQs: Hottest Markets in Peak Rental Season 2025

Q: What’s the hottest rental market this peak moving season?

A: Miami still leads, but Chicagoland is also extremely competitive due to limited options.

Q: Which U.S. region is most competitive for renters this peak season?

A: The Northeast ranks first, with the Midwest close on its heels.

Q: What are the top trending rental markets this peak season?

A: The Twin Cities and surrounding suburbs are the fastest-rising markets, with San Francisco also heating up.

Q: What’s the hottest small rental market during peak season?

A: Lafayette, IN, is the nation’s hottest small rental market.

Q: Which are the fastest-rising rental markets this peak season?

A: Lafayette–Lake Charles, LA, and Port St. Lucie, FL, are the top trending small rental markets.

Methodology

RentCafe.com is a nationwide apartment search website that enables renters to easily find apartments and houses for rent throughout the U.S.

To compile this report, RentCafe.com’s research team analyzed Yardi Systems apartment data across 139 rental markets in the U.S. The data comes directly from market-rate, large-scale, multifamily properties of at least 50 units. Fully affordable multifamily properties were excluded.

The markets were ranked based on a market competitive score. To calculate each market’s score, we ranked them according to five metrics and their averages for the second quarter of 2025 (April through June): apartment occupancy rate; average total days vacant; prospective renters per vacant unit; renewal lease rate; and share of new apartments completed during the same timeframe compared to the existing overall supply at the start of Q2 2024.

We then compiled an average ranking by assigning a percentage weight for each metric: 30% for apartment occupancy rate; 15% for average vacant days; 15% for prospective renters per vacant unit; 30% for renewal lease rate; and 10% for the share of new apartments.

In this study, the terms “market,” “area,” “metro” and “location” are used interchangeably and are as defined by Yardi Matrix markets.

Fair use and redistribution

We encourage you and freely grant you permission to reuse, host, or repost the research, graphics, and images presented in this article. When doing so, we ask that you credit our research by linking to RentCafe.com or this page, so that your readers can learn more about this project, the research behind it and its methodology. For more in-depth, customized data, please contact us at media@rentcafe.com.

Share this article:

Veronica Grecu is a senior creative writer and research analyst for RentCafe. With more than 14 years of experience in the real estate industry, she covers a variety of topics in the apartment market, including rental competitiveness, new construction and other industry trends. Her work has been featured in top publications like The New York Times, The Washington Post, The Wall Street Journal, The Philadelphia Inquirer, The Miami Herald, CNN, CNBC, and more. Prior to RentCafe, Veronica was involved in producing real estate content for Multi-Housing News, Commercial Property Executive and Yardi Matrix. She holds a B.A. in Applied Modern Languages and an M.A. in Advertising and PR.

The Ready Renter has your back

Tips, news, and research curated for renters, straight to your inbox.

Related posts

Subscribe to

The Ready Renter newsletter