Real Estate Realities: A Look at the Homes TV Characters Could Actually Afford in 2017

Share this article:

When considering buying a house or renting an apartment, financial experts recommend following the 30 percent rule. This means your monthly or annual housing costs (whether it’s rent or a mortgage) should not exceed 30 percent of your monthly or annual income. Pretty simple, right? Maybe not so much.

In the real world, we don’t always abide by those numbers. And as we’ll discover, we don’t always see the best — or even realistic — examples of homeownership on the small screen either. A few standout examples from some of our favorite TV characters showcase what the highs and lows of homeownership might look like in the real world, and their budgets may surprise you. Keep reading to see what we discovered about the real-life possibilities of some of the most iconic dwellings on TV.

Pragmatic Payments

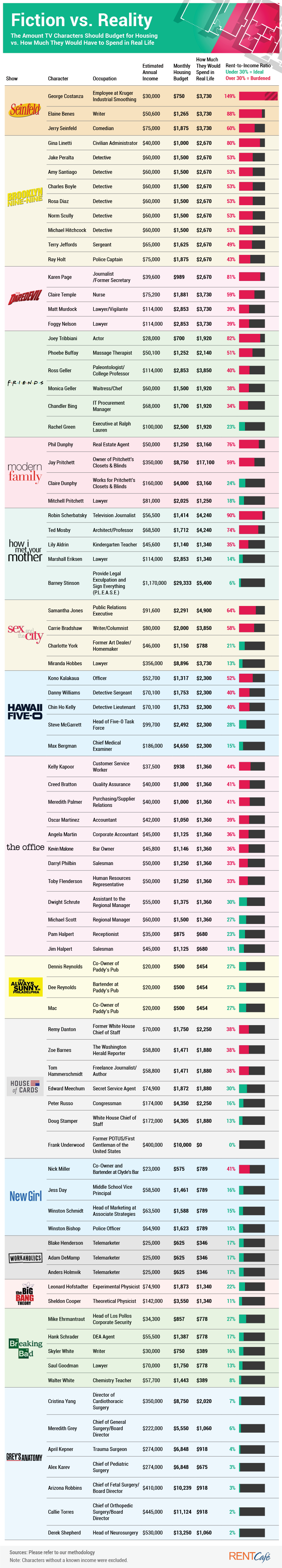

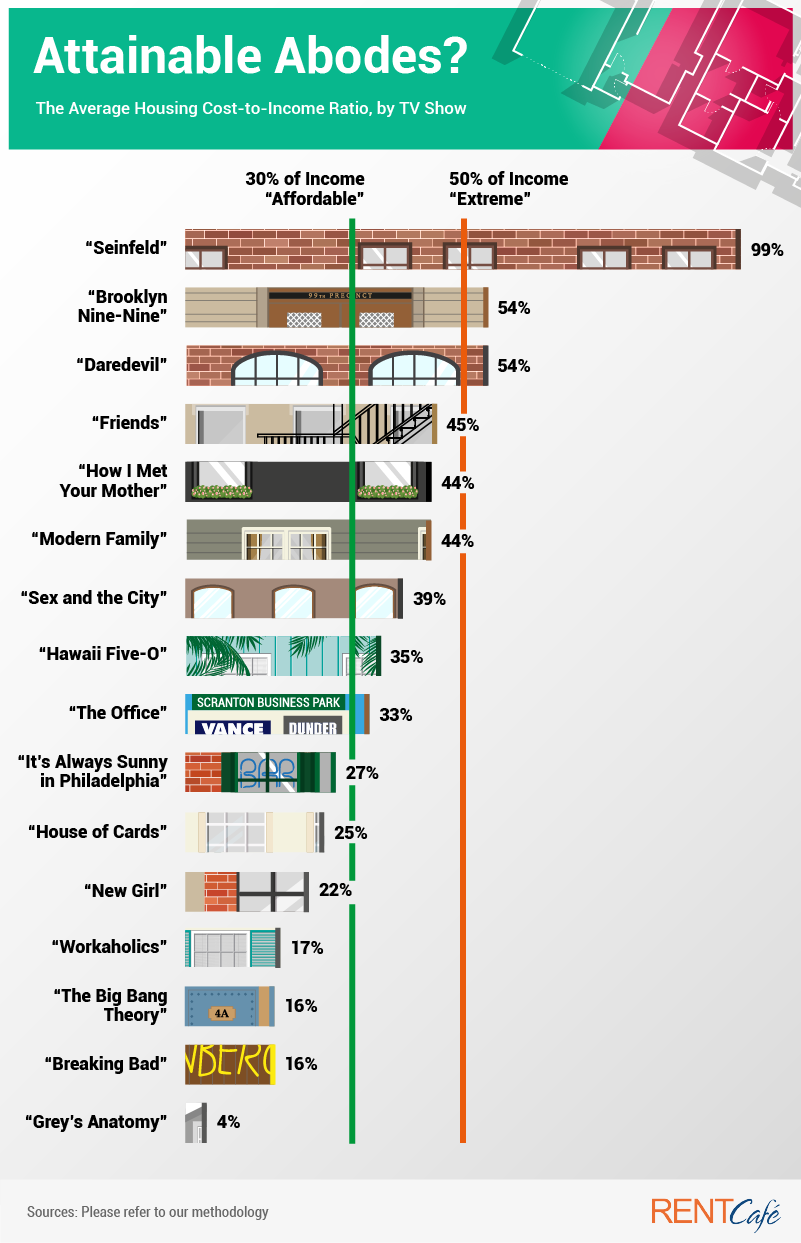

Based on what we know about the industries in which some of our favorite TV characters are employed, we compiled their theoretical annual incomes and housing costs to determine how far over (or under) they fell within the 30% rule. As it turns out, just about every TV character might be living outside their means where their monthly housing allowance is concerned.

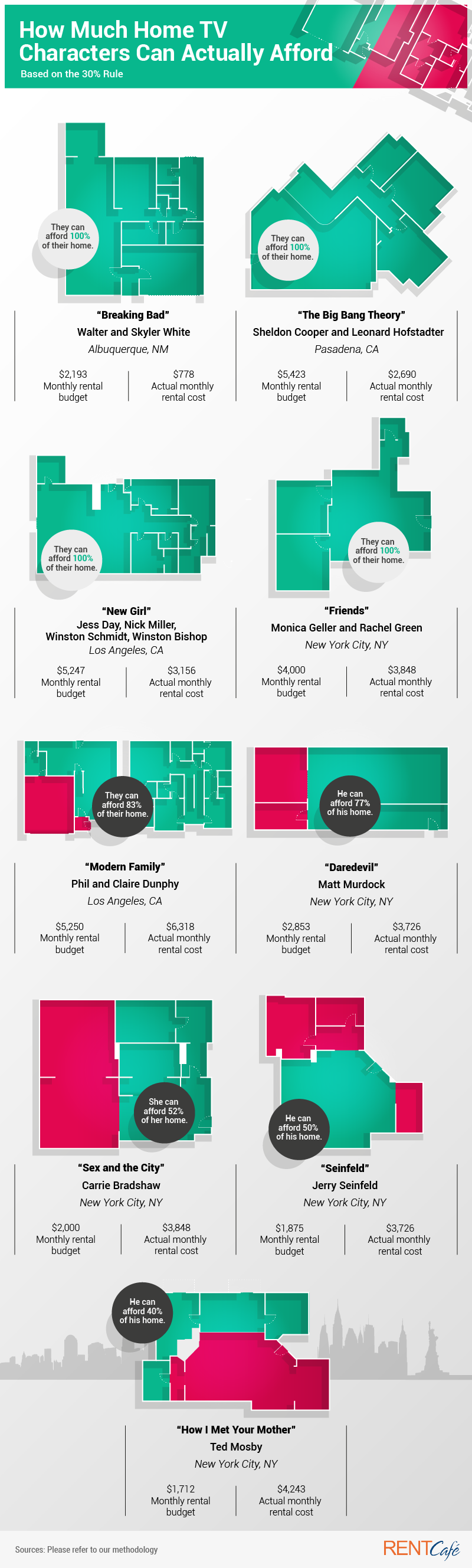

Sheldon and Leonard from “The Big Bang Theory” are self-proclaimed nerds and, coincidentally, self-proclaimed geniuses. Both Ph.D. graduates and research scientists at Caltech are estimated to earn nearly $217,000 combined a year. If they responsibly followed the 30 percent rule, this would give them just over $5,400 to spend each month on their shared two-bedroom apartment. By our estimation, they’re only spending a fraction of that amount, putting them well within the threshold of a healthy housing budget.

In reality, TV characters residing in New York City would have the hardest time affording their homes. There is no question apartments for rent in the Big Apple are pricey, and these characters would go broke with their swanky digs.

By our calculations, George Costanza from “Seinfeld” would be the biggest perpetrator of all. Earning roughly $30,000 a year at Kruger Industrial Smoothing, we estimate his apartment in the Big Apple would set him back over $3,700 a month — or 149% of his monthly income.

A fellow New Yorker, Robin Scherbatsky from “How I Met Your Mother” isn’t far behind when it comes to unrealistic income-to-housing portrayals. As we saw over the show’s nine seasons, this Canadian-displaced New Yorker pursued her dream of being a big-time TV anchor to no avail. At one point, she was even in danger of being deported back to Canada for having no job at all. Based on our estimation of Robin’s annual income and the cost of her apartment, she’d be spending 90% of her monthly income on housing in the real world. Simply put, there’s no way she could ever have afforded that apartment.

Monica and Rachel from the iconic ’90s TV show “Friends” earned an estimated $160,000 combined annually as a chef (Monica) and Ralph Lauren executive (Rachel). The roomies would have about $4,000 a month to put toward the cost of their plush New York City apartment if they followed the 30 percent rule.

However, some of the characters we grew to love on TV did set the right example and followed the 30 percent rule. Jim and Pam from “The Office” weren’t just #RelationshipGoals — they were #FinanceGoals too. They would have spent about 18% of their annual income on housing expenses while working for Dunder Mifflin. And Barney from “How I Met Your Mother,” who is estimated to have earned millions of dollars each year, probably would have lived quite comfortably in his lavish digs as well, while spending 6% of his total income on his apartment.

Big Budgets in Big Cities

Some shows set a better (and more realistic) example than others.

If the playful antics we’ve seen over the last eight seasons of “Modern Family” have given you a bit of family envy, don’t worry. The odds of a real-life family ever being so funny or being able to afford such nice homes are probably pretty slim. In fact, the home showcased as the Dunphy’s Los Angeles residence went on sale in 2014 and cost a whopping $2.35 million. Combined, the total housing costs of all the characters on “Modern Family” accounted for 44% of their annual incomes.

Other shows set in some of the biggest cities set even less realistic expectations. In Manhattan-based shows like “Seinfeld”and “Daredevil” and “Brooklyn Nine-Nine,” which is obviously set in Brooklyn, the characters would have spent half or more of their annual income just to pay rent. That probably wouldn’t have left them with too much extra money for eating at those iconic cafes and restaurants.

Shows where homes and apartments might be a fair representation of what characters could afford? “Breaking Bad” (only accounting for the money obtained legally), “Workaholics,” “The Big Bang Theory” and “Grey’s Anatomy.”

Realistic Living Arrangements

Based in Pasadena, CA — just outside of L.A., where apartments are listed for $1,800 or more — Sheldon and Leonard’s apartment from “The Big Bang Theory” probably set them back $24,000 a year. Given their estimated annual income and the likelihood that they could afford just over $65,000 a year for housing annually, this puts both men comfortably in the green by our assessment.

Walter and Skyler White from “Breaking Bad” certainly have more than a few bucks living off the books where their annual income is concerned, but if we only took the money they earned legally into account, they’d still do pretty well. With an annual housing budget of just over $26,000, they probably would have spent around $14,000 a year for their home in Albuquerque, NM.

Matt Murdock doesn’t need traditional vision to know his apartment in the Hell’s Kitchen neighborhood of Manhattan was pretty nice. Still, Manhattan apartments can get pricey, and we don’t see Mr. Murdock (or even Daredevil himself) earning a lot of money from clients. We expect the money Daredevil brought in from Nelson and Murdock would have allowed just over $34,000 a year for his apartment, which would only pay for renting about about three-quarters of the apartment, according to the 30 percent rule.

Here’s where things really get sticky. Monica and Rachel in “Friends” had one of the nicest New York City apartments we’ve seen on TV. Even the apartment across the hall where Joey and Chandler lived wasn’t quite as fancy or even as big. By our calculations, Monica’s apartment should have cost $54,000 a year. It’s worth noting that the show does indicate Monica inherited the apartment from her grandmother, and it was rent-controlled to keep the cost affordable. If Monica and Rachel budgeted about $48,000 for their annual housing costs, they would have been $6,000 short of their estimated rent in real life. So, maybe they should have invested in a coffee machine instead of ordering all those lattes at Central Perk.

Ted from “How I Met Your Mother” was an architect, but that didn’t immediately qualify him for his amply-sized two-bedroom apartment. We estimated Ted should have had a $20,550 budget for his annual housing costs, but he probably spent $36,000, considering the size of the apartment and its prime location. In reality, Ted could only have afforded 57% of his apartment, according to the 30 percent rule.

The Dunphys from “Modern Family” may have overstretched themselves just a bit on their four-bedroom home in California. Between Claire’s job working at Pritchett’s Closets & Blinds and Phil’s job as a realtor, the Dunphy’s should have had an annual housing budget of $63,000. Their home would have likely cost nearly $76,000 a year, putting them in the red by nearly 20%.

Life in the City of Angels probably has its perks — great weather and beautiful beaches, along with interesting (and sometimes famous) people. Even small apartments for rent in L.A. start around $1,500 and go up. In “New Girl,” Jess and her crew enjoyed a pretty nice pad that would cost nearly $89,000 a year. According to our calculations, they would have to spend just under $63,000, meaning they could only afford roughly 71% of their apartment.

Some may consider “Seinfeld” a classic, but it’s also a show where the characters could have only afforded about half the space of their homes. Based on Jerry’s annual income, he would have had over $22,000 a year to spend on his place. We know Jerry needed a place for all those cereal boxes, but his “Seinfeld” apartment would have cost nearly $41,000 a year.

Home Hunting in Real Life

You can’t believe everything you see on TV, and that’s especially true when it comes to finding the perfect apartment. From L.A. to New York City, the homes and apartments on some of our favorite TV shows aren’t always indicative of reality when it comes to the cost of living and affordability.

If the homes you see on TV make you feel a little green with envy—don’t worry. For the most part, a majority of these characters can’t afford those apartments in the first place.

Methodology

We researched salary and housing costs for popular TV characters where possible (see the sources here). For salaries and housing costs without available reliable data, we estimated using data on housing costs in each city, as well as public salary data related to each character’s profession. All rental prices are from RentCafe.

Fair use and redistribution

We encourage you and freely grant you permission to reuse, host, or repost the images in this article. When doing so, we only ask that you kindly attribute the authors by linking to RentCafe.com or this page, so that your readers can learn more about this project, the research behind it and its methodology. For more in-depth, customized data, please contact us at media@rentcafe.com.

Share this article:

Balazs Szekely, our Senior Creative Writer has a degree in journalism and dynamic career experience spanning radio, print and online media, as well as B2B and B2C copywriting. With extensive experience at several real estate industry publications, he’s well-versed in coworking trends, remote work, lifestyle and health topics. Balazs’ work has been featured in The New York Times, The Washington Post, and The Wall Street Journal, as well as on CBS, CNBC and more. He’s fascinated by photography, winter sports and nature, and, in his free time, you may find him away from home on a city break. You can drop Balazs a line via email.

The Ready Renter has your back

Tips, news, and research curated for renters, straight to your inbox.

Related posts

Subscribe to

The Ready Renter newsletter