Homeownership Dream Still Alive for Renters, but Majority Prefer to Rent

Share this article:

The recent upswing in the rental market has resulted in higher rents and a competitive environment for the country’s renters. The average rent has increased 4.3% Y-O-Y, hitting $1,105 in April, and all signs point to further growth.

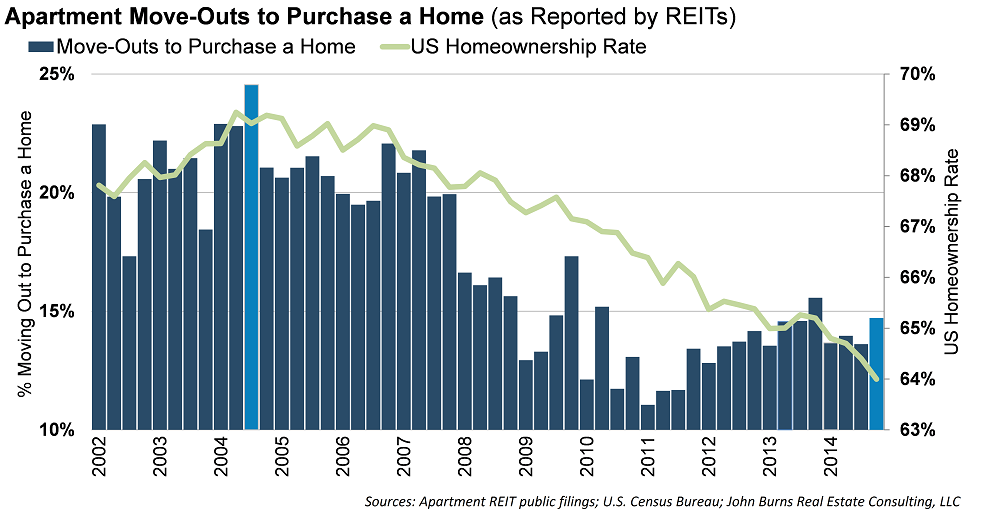

Even with mortgages becoming more affordable and the rental market getting tighter, most renters still prefer to stay put. As of Q4 2014, just 14.7% of all tenants moving out of a property purchased a home, according to a recent analysis by John Burns Real Estate Consulting. The homeownership rate hit historical lows this year, declining to 63.7% in Q1 2015, the lowest since the mid-90s.

While millennials still make up a large part of today’s renter cohort, renting has started to appeal to a broader spectrum of consumers. Many of the nation’s renters – whether Gen Y-ers, Gen X-ers, or Baby Boomers – choose to rent because of the flexibility and convenience that this way of life entails.

What Renters Want: Affordability, Lifestyle, Convenience

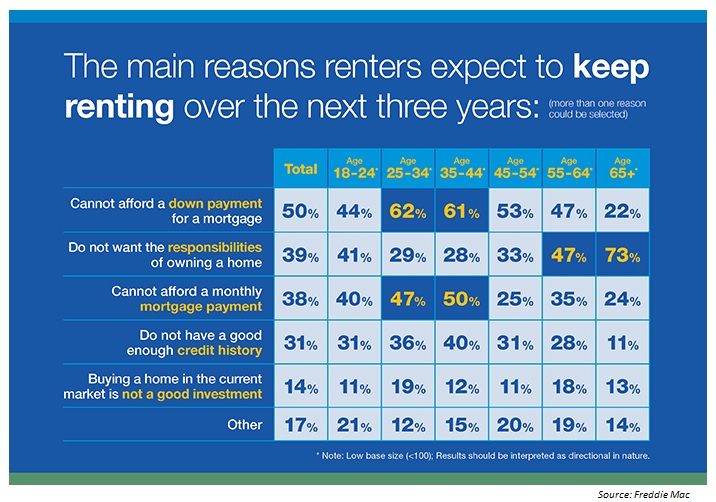

A recent Freddie Mac report shows that 61% of renters believe they will continue to rent in the next three years, although the vast majority of them (91%) view homeownership as something of which to be proud. While 39% of all renters say they expect to buy a home in the next three years, the remainder plan to continue to rent. Those most likely to acquire a home in the next three years are between the ages 25-44.

The decision to buy vs. to own is most often related to the actual location of the renter and the market’s affordability index. In markets where housing costs are much higher than those associated to renting, such as San Francisco, Silicon Valley, NYC, or Washington, D.C., renting emerges as a much more viable alternative – one that actually involves less financial hurdles and provides freedom from home maintenance responsibilities. This rising demand for apartment living has helped push vacancy rates down, with the U.S. rental vacancy rate dropping to 7.1% in the first quarter of 2015 from 8.3% the year earlier, Census data shows.

[mks_button size=”medium” title=”Browse apartments for rent on RentCafe” style=”squared” url=”https://www.rentcafe.com” target=”_blank” bg_color=”#ed6d2f” txt_color=”#FFFFFF” icon=”fa-search” icon_type=”fa”]

Moreover, the new generation of apartment buildings comes with a set of amenities that homeowners would find hard to procure or maintain. Beautifully landscaped courtyards, rooftop gardens, infinity pools, cyber cafés, and state-of-the-art fitness centers are becoming more and more common in rental communities all across the U.S., and renters are jumping at the opportunity to live in such exclusive environments.

Take the Post Midtown Square community in Houston, for example, where rents start from around $1,200. Conveniently located in the dynamic Midtown area, just two blocks south of downtown Houston, and two miles north of the Museum District and the Medical Center, it caters to both young professionals and families with kids.

The complex offers a mix of studio, one-, and two-bedroom luxury homes with bay windows, faux wood flooring, maple cabinets and granite countertops, balconies and patios. Among several upscale amenities, the community features ground floor retail outlets, gorgeous courtyards, a 3,000-square-foot fitness center, three pools, and garage parking. And you can actually walk to popular shopping and entertainment destinations, which is definitely a plus.

What’s your take on this? Would you rather buy or rent your next home? Let us know in the comments section below.

Share this article:

Amalia Otet is an online content developer and creative writer for RENTCafé. She loves all things real estate and strives to live beautifully, one green step at a time.

The Ready Renter has your back

Tips, news, and research curated for renters, straight to your inbox.

Related posts

Subscribe to

The Ready Renter newsletter