RentCafe.com’s new features: The Rent vs. Buy Calculator makes math easy

Share this article:

Deciding whether to rent or buy a home is one of the biggest financial choices many of us face and it’s not always easy to tell which option makes more sense. That’s where the new Rent vs. Buy Calculator comes in — the highlight of this month’s new features on RentCafe.com.

This free easy-to-use tool helps you compare the true costs of renting versus buying based on location, budget, and goals. By entering just a few basic details you can transform complex financial scenarios into clear insights and see which option fits you best.

And that’s just the beginning. Along with this powerful new tool, RentCafe.com also launched fresh features to make your apartment search experience even smoother and more enjoyable: from bold new colors to improved navigation and renter-friendly resources.

1. Crunching the numbers with RentCafe.com’s new Rent vs. Buy Calculator

Deciding whether to rent or buy doesn’t have to be confusing. The Rent vs. Buy Calculator on RentCafe.com turns those tricky “what ifs” into real numbers that make sense. This free tool is quick, interactive and designed to help renters like you understand which option fits their lifestyle and budget best.

This fresh new feature can be an essential first step when considering buying a home. By filling in some basic cost information, the calculator gives you an easy-to-grasp overview of what becoming a homeowner might mean for your budget versus your expenses as a renter.

You’ll even get a graph to help put things into perspective even better. And that’s not all. By scrolling down to the Rent vs. Buy calculator’s page, you’ll see some very important questions to help you advance in your journey.

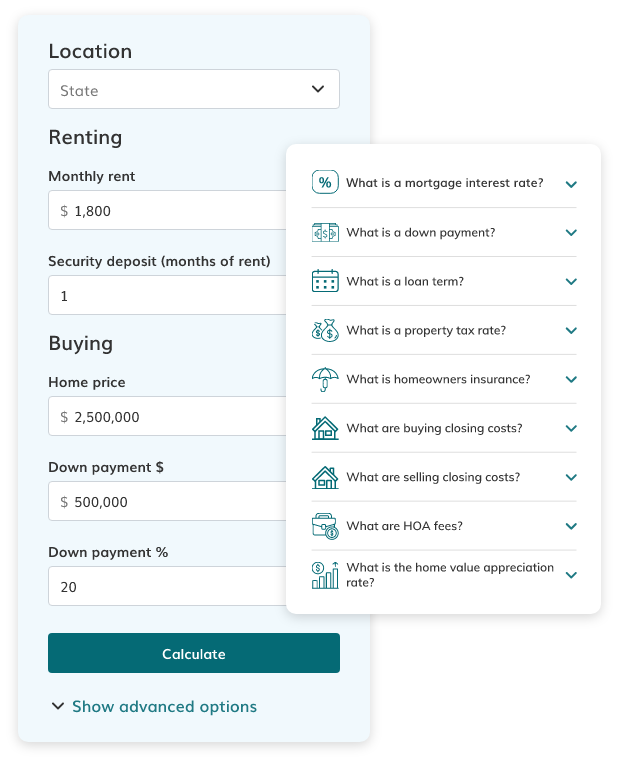

Oh, and no need to worry about what all those financial terms mean. The calculator includes a helpful glossary where all the money talk is explained clearly.

How to use the Rent vs. Buy Calculator

Using the calculator means filling in the fields with your rent costs, home price, down payment and other expenses. You can also use the “advanced options” section for a more accurate calculation.

What’s great about it is that you don’t need to know all the secondary expenses and rates for the advanced version. To start using the Rent vs. Buy Calculator, follow this step-by step guide:

Step 1: Start with the basics

Enter a few key details to personalize your results:

- The location where you plan to live

- The price of the home you’re considering

- Your down payment amount

- The monthly rent you are paying now or that you’d pay if you didn’t buy

Based on the location where you want to live, the calculator automatically fills in the info based on state averages. However, you can always adjust the data to reflect your situation. That’s all you need to get a clear starting point.

Step 2: Fine-tune your numbers (optional)

For a more detailed breakdown, click “Show advanced options.” This lets you add info like:

- Loan terms (interest rate and number of years)

- Property taxes and homeowner’s insurance

- Maintenance costs or HOA fees

- Closing costs and rent appreciation rate

- Income tax rate and tax deductions

You don’t have to fill these in — but doing so gives you a more accurate, realistic comparison.

Step 3: See your results

In seconds, you’ll get an interactive graphic that shows how renting and buying stack up over time. You can easily spot which path may save you more money — whether in the short term or long run.

Step 4: Decide with confidence

The calculator wraps up your inputs and results in a simple summary, showing which option is likely the better fit for your situation. With that insight, you can take the next step knowing the numbers are on your side.

Whether you’re browsing apartments or thinking about homeownership, the Rent vs. Buy Calculator gives you clarity before you commit — and that’s a smart move no matter where you want to live.

Avoid these common mistakes when using the Rent vs. Buy Calculator

The Rent vs. Buy Calculator does a lot of the heavy lifting for you, especially since it automatically fills in many fields based on your location. Still, there are a few ways to make your results more meaningful. Here’s what to watch out for:

1. Not updating the numbers to match your situation

Even though the calculator uses state averages, your personal numbers — like the exact rent you pay or your preferred down payment — might differ quite a bit.

Tip: Double-check and adjust the prefilled data to reflect your actual costs and plans. That way, the comparison between renting and buying will be truly personalized.

2. Ignoring how long you plan to stay put

How long you’ll live in the home plays a huge role in whether buying makes sense. If you move before you’ve built enough equity, the costs of buying and selling can outweigh the benefits.

Tip: Use the calculator’s results to find the “breakeven” point — the number of years after which buying starts to pay off.

3. Overlooking what the numbers really mean

It’s easy to focus on the “total costs” and overlook the “total net cost,” which actually shows the true financial impact after accounting for home equity and appreciation.

Tip: Take a moment to review the full cost breakdown. Understanding what each number represents helps you make a smarter, more confident decision.

By keeping these small details in mind, you’ll get the most accurate and useful insight from the Rent vs. Buy Calculator — and a clearer picture of which option truly fits your lifestyle and budget.

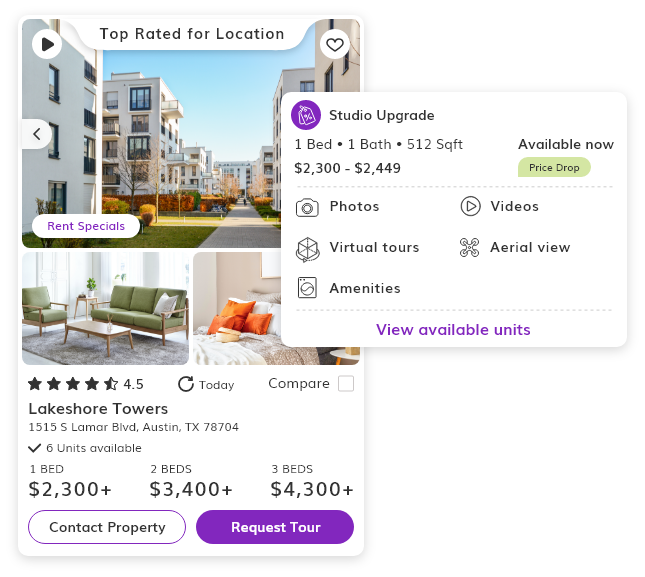

2. RentCafe.com’s exciting new look

Have you noticed RentCafe.com’s new look? If you’ve visited recently, you probably spotted it right away.

The updated design creates a more inviting and relaxed atmosphere to make your rental search easier and more enjoyable. With a cleaner layout and improved navigation, exploring listings feels smoother and less stressful. It’s welcoming and friendly yet bold enough to help you find the perfect apartment faster.

Did you know? Fresh data for smarter decisions

RentCafe.com’s Average Rent page just got a big data update! Now, all numbers are fresher, more accurate, and ready to help you make smarter renting decisions. Whether you’re comparing cities or checking the typical rent in your area, you’ll get real-time insights that reflect today’s market. We’re here to give you the latest info for more clarity and confidence in your rental journey.

From a bold new look to more intuitive tools, everything we do is designed with you in mind. We want your time on the site to be efficient and enjoyable.

From a bold new look to more intuitive tools, everything we do is designed with you in mind. We want your time on the site to be efficient and enjoyable.

Ready to find your next happy place? Log in to RentCafe.com today and discover how these features can help you find your next apartment with greater ease and confidence.

Share this article:

Adina Dragos is a real estate writer and research analyst with RentCafe. She has solid experience in real estate writing, covering topics ranging from best cities for renters and the top cities for rental activity to cost of living. Her work was featured in several prominent media channels such as Axios, The Dallas Morning News, ConnectCre and The New York Times.

The Ready Renter has your back

Tips, news, and research curated for renters, straight to your inbox.

Related posts

Subscribe to

The Ready Renter newsletter