Share this article:

Looking for an apartment isn’t just about finding the cheapest rent. Sure, rent usually takes up the biggest chunk of your budget, but it’s only part of the story. Utilities, groceries, transportation, and health care all add up — and often more than you expect. If you only focus on rent, you might sign a lease that looks affordable on paper but ends up stretching your finances once everything else piles on.

That’s where a cost-of-living calculator can really help. Instead of guessing, it gives you a clearer picture of what your monthly expenses will look like in a new city or neighborhood. This way, you avoid surprises and make a smart decision based on the facts, not just assumptions.

Key Takeaways:

-

- Rent is only one part of your housing costs; other categories like groceries, utilities, and transportation matter just as much.

- A cost-of-living calculator gives you a clear comparison between locations so you can see trade-offs before moving.

- The tool works best when you enter accurate lifestyle details and pay attention to the breakdown, not just the total.

- Using it can prevent surprises, reduce moving stress, and give you confidence in your financial decisions.

What exactly is a cost-of-living calculator?

A cost-of-living calculator is an online tool designed to estimate how much money you’ll need to maintain your lifestyle in a specific location. It looks at common expenses like rent, groceries, utilities, transportation, health care, and sometimes even entertainment. The best part? You enter your current city and the one you’re considering, and it compares costs side by side. This helps you see right away if moving will save you money or add strain to your budget.

Why do apartment-hunters love a cost-of-living calculator?

For renters, the biggest plus of a cost-of-living calculator is avoiding nasty surprises down the road. It stops you from picking an apartment that looks affordable but then leaves you scraping to pay utilities or get around. Seeing the full cost upfront means you make decisions based on your entire budget, not just the rent number.

On top of that, it takes a lot of stress out of moving. Moving is already tough with packing, paperwork, and leaving behind what you know. Knowing your financial picture ahead of time takes away one huge worry. In the end, using this kind of planning doesn’t just save money — it gives you confidence and makes starting fresh a lot smoother.

How do you use a cost-of-living calculator? A step-by-step example

For example, imagine you currently live in Portland, OR and are thinking about moving to Raleigh, NC. Here’s how a cost-of-living calculator can help you understand the financial differences and make a better decision:

1. Compare rent costs

Rent in Portland, OR averages about $1,756 per month, while in Raleigh it’s $1,607. Remember, although lower rent can ease your budget, it’s important to consider all other expenses before deciding.

2. Look at grocery expenses

Groceries are generally cheaper in Raleigh. For example, milk costs $4.58 in Raleigh versus $4.93 in Portland, and coffee is $5.44 compared to $6.85. While potatoes are higher in Raleigh at $4.98 versus $3.93 in Portland, overall, basic items like eggs, cheese, and bread tend to cost less, making grocery shopping more affordable in Raleigh.

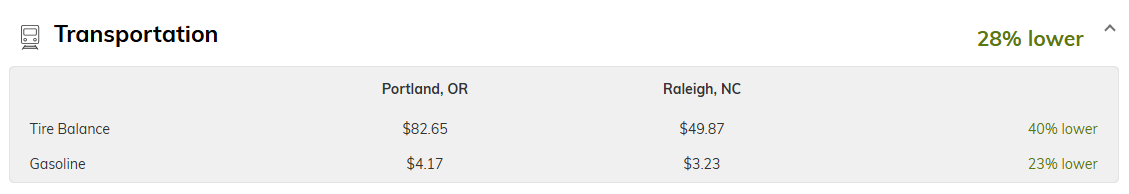

3. Consider transportation needs

Transportation expenses tend to be lower in Raleigh. For example, tire balancing costs about 40% less at $49.87 compared to $82.65 in Portland. Gasoline prices are also cheaper, averaging $3.23 per gallon in Raleigh versus $4.17 in Portland. These differences can add up for drivers and impact your overall budget.

4. Check utility bills

Utility expenses are fairly similar between the two cities. Energy costs in Raleigh are about 5% higher at $176.18 compared to $167.18 in Portland, while phone bills are nearly the same, with Raleigh slightly higher at $189.30 versus $186.81.

5. Analyze the overall impact

At first glance, Raleigh may appear more affordable with lower grocery and transportation costs, but some utility expenses are slightly higher than in Portland. It’s important to carefully review each category to understand where your expenses might increase or decrease.

6. Reflect on your lifestyle and priorities

If you rely on public transportation or prefer not to drive, Portland’s transportation options may better suit you, despite some higher grocery prices. On the other hand, if you’re comfortable driving and want to benefit from lower transportation costs, Raleigh could be a better fit. Using a cost-of-living calculator can help you clearly compare these factors and make a well-informed choice.

How do you get the most out of a cost-of-living calculator?

Using one is simple, but getting helpful results means being honest with yourself about how you live and spend. If you eat out a lot, the grocery savings you see might not make much of a difference. If you usually rely on public transit, living somewhere that needs a car can shake up your budget more than you realize.

Don’t just glance at the final number. Dig into each category to see where you’re saving and where you might spend more. Try out different scenarios too, like comparing neighborhoods within the same city or thinking about different ways you’d get around. When you do this, you stop guessing and start seeing exactly how your lifestyle choices play out financially in a new place.

What are some common mistakes people make when using a cost-of-living calculator?

Cost-of-living calculators can be really helpful, but they’re easy to misuse. A common mistake is focusing only on the total number without looking at how different expenses add up—like cheaper rent but higher transportation costs. Another is not being honest about your lifestyle; underestimating things like dining out can make the results look better than real life.

People also forget that costs change over time — rent, gas, and utilities can fluctuate — so the calculator should be seen as a flexible tool, not a fixed answer. Finally, it’s important to consider income too. Moving somewhere cheaper won’t help much if your salary drops significantly, so both costs and earnings need to be weighed.

When searching for an apartment, a cost-of-living calculator can be a valuable tool that helps you stay within your budget. Instead of relying on guesses, it provides clear information that allows you to make well-informed decisions. By using it, you can avoid unexpected expenses and financial strain while maintaining your desired lifestyle.

Cost-of-living Calculator Guide Q&A

Q: What is a cost-of-living calculator and how does it work?

A: A cost-of-living calculator is an online tool that compares expenses like rent, utilities, groceries, and transportation between two locations.

Q: Why should renters use a cost-of-living calculator before moving?

A: Renters use cost-of-living calculators to see the true cost of living in a new city and avoid financial surprises.

Q: How accurate is a cost-of-living calculator?

A: A cost-of-living calculator provides reliable estimates based on averages, but accuracy depends on entering honest spending habits.

Q: Which expenses does a cost-of-living calculator include?

A: Most calculators include rent, groceries, utilities, transportation, and health care, with some also covering taxes and childcare.

Q: When is the best time to use a cost-of-living calculator?

A: The best time to use a cost-of-living calculator is before relocating, during apartment-hunting or job-search planning.

Share this article:

Adina Dragos is a real estate writer and research analyst with RentCafe. She has solid experience in real estate writing, covering topics ranging from best cities for renters and the top cities for rental activity to cost of living. Her work was featured in several prominent media channels such as Axios, The Dallas Morning News, ConnectCre and The New York Times.

The Ready Renter has your back

Tips, news, and research curated for renters, straight to your inbox.

Related posts

Subscribe to

The Ready Renter newsletter